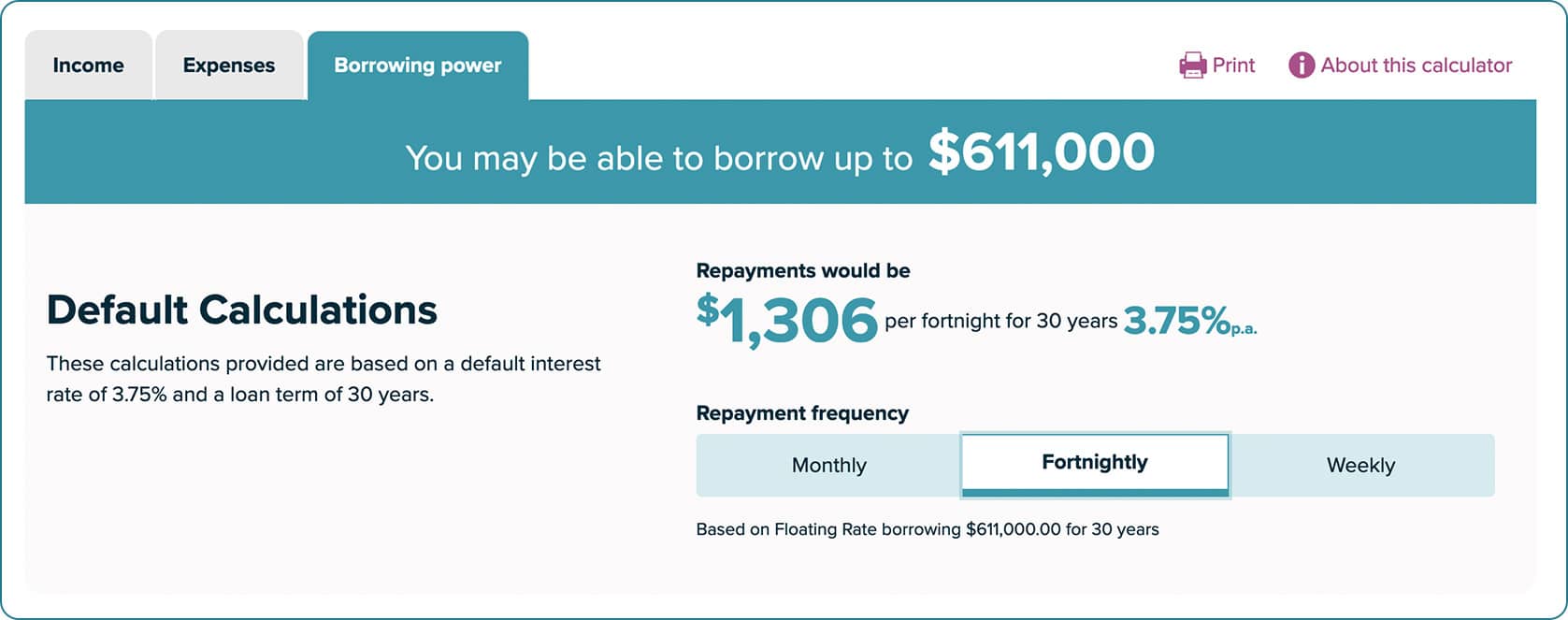

The newest calculator spends the better of your own default projected monthly way of life expenditures and/or living expenses you may have entered. For individuals who’ve receive your perfect home and you can seemed the borrowing from the bank skill, only to realize that you do not a bit qualify for the loan you had hoped for — don’t get worried; it is possible to increase your borrowing strength. Very home loans are supplied more thirty years (360 months), and this maximizes borrowing from the bank energy. If you are extended terminology occur, it trigger using much more complete interest over the lifetime of the mortgage.

- It’s necessary to keep up so far on the current stamp obligation requirements by examining the newest property webpages of your state otherwise territory authorities, because these regulations try at the mercy of .

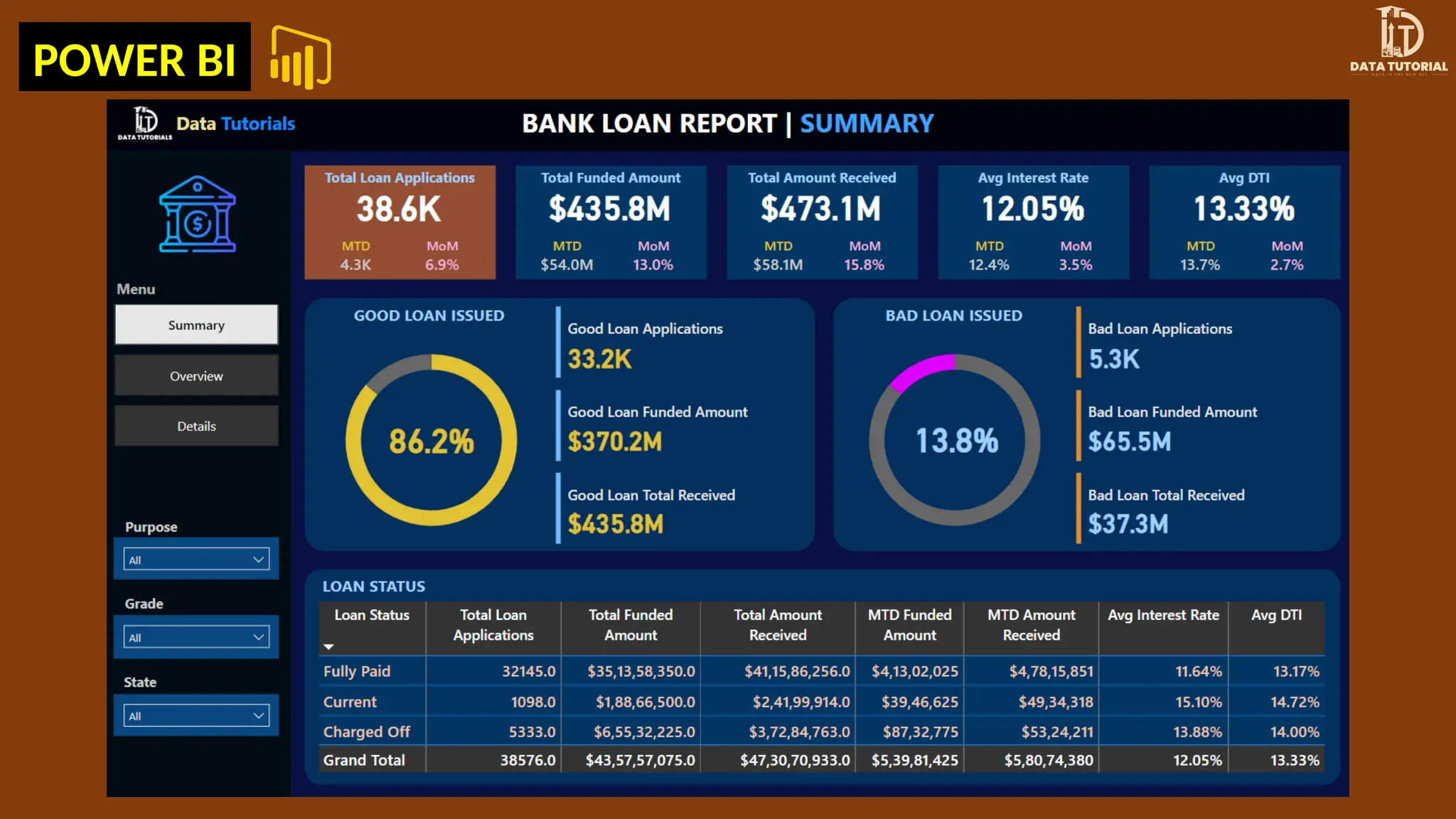

- You might calculate your DTI by the addition of in the total matter of your own bills and you will breaking up by your gross yearly earnings (before income tax).

- He had worked for Bankrate, in which the guy protected the new property growth and you may chest.

- Research times to own financial applications generated thru Tiimely Household agents are determined by individual panel loan providers.

- Besides, there may likely be charges for hooking up resources such energy, internet sites, fuel, and you may drinking water.

- The fresh InfoChoice Category try wholly owned by KCBL Pty Ltd just who are included in the brand new Firstmac Category.

Free download ANZ Assets Character Declaration

The new Set-aside Financial away from Australia provides remaining the money speed during the step three.6% to get rid of 2025, having places now.

.. Two of the nation’s prominent financial institutions are actually anticipating the new Reserve Lender of Australia (RBA) … Are you self-operating, a laid-back staff, otherwise depending to the penalty costs? A loan provider might consider any debt you gain access to and take away its worth from the contour it manage otherwise give you. There are certain reasons why refinancing would be a great great idea – the greatest becoming financial. Because of it calculation the mortgage so you can well worth proportion never surpass 95%.

Our very own people make up us to own adverts that appear to the the site. So it payment helps us render products and you can features – such as totally free credit rating access and you can monitoring. Other variables are the borrowing profile, unit access and you will proprietary webpages techniques. To possess focus only changeable financing, the newest assessment rates are based on a first 5 year focus just term. To possess fixed speed focus simply finance, the fresh evaluation cost are based on a first attention simply period equal inside identity for the repaired several months. The fresh formula from estimated restrict financial borrowing from the bank electricity excludes Lenders Mortgage Insurance rates.

Consider your own HECS debts

Whether or not you’re considered renovations, merging financial obligation, or funding an enormous milestone, our house collateral hand calculators are right here to help. If the a loan provider can be involved your expenses are too large, they could lower your borrowing from the bank capability. If the currency arriving still isn’t sufficient, there are many different a means to enhance income.

As experienced, the merchandise and you may speed should be clearly authored on the equipment provider’s webpages. YourMortgage.com.bien au, InfoChoice.com.au, Deals.com.au and you can YourInvestmentPropertyMag.com.bien au are included in the brand new InfoChoice Category. The newest InfoChoice Classification is actually wholly belonging to KCBL Pty Ltd who are included in the fresh Firstmac Classification.

Why must I get a mortgage that have ING?

In the YourMortgage.com.bien au, our company is passionate about providing Australians build advised economic decisions. The dedicated article party work tirelessly to give you exact, related, and you may objective suggestions. We satisfaction our selves to the keeping a rigorous break up anywhere between all of our article and you can commercial communities, making sure the content you realize is based strictly to your quality and never determined by commercial hobbies. Large four financial Westpac provides additional around thirty-five base issues to the fixed financial rates after t… A couple of Australia’s extremely recognisable financial institutions raised repaired financial rates to the Tuesday, followi…

That it calculator cannot think HECS expenses, that could lower your borrowing skill. If you undertake a home loan having one of the panel of loan providers playing with a good Tiimely Household representative, your borrowing from the bank capability may differ based on your loan alternatives. You will find determined your own projected borrowing from the bank electricity based on the income, expenditures and other guidance you given. The brand new guess cannot take into account our financing qualification criteria, nor consider carefully your over budget. The fresh data and you will figures provided by so it device are based on the brand new restricted advice you may have offered and you will certain default assumptions.

If a loan provider isn’t a little happy to provide around your asked, you might ask yourself as to the reasons. You will be coordinated having a skilled large financial company that will handle all the the hard do the job at all times. Once you’ve these to hand, using the calculator is simple. Although not, your own limitation purchase price can get improve when you yourself have a high deposit. Observe much you may have to pay within the stamp obligations and see just what assistance was available to choose from. Work at the fresh number with the calculators, up coming guide a consultation with an Aussie Broker to go over the choices.

Your specific price depends on the top Price along with an excellent margin influenced by their creditworthiness. While we usually do not publish live rates, all of our calculator helps you recognize how other costs affect your repayments. Typically, lenders enables you to obtain up to 85% of the home’s value, without your an excellent home loan balance. Points such as your credit rating and loans-to-earnings proportion along with enjoy a crucial role. Our house security personal line of credit estimator will bring a reputable computation centered on these types of issues.

Hear about just how InfoChoice Category takes care of prospective problems of great interest, in addition to how exactly we receive money. The newest financial sector’s development magnet provides hiked much of their fixed rate mortgage line-up amid … The biggest of the big five banking companies provides strolled straight back a small amount of time cuatro.99% p.a good.

If you’d want to learn how to calculate stamp obligation or other upfront costs, have fun with the deposit, costs and stamp responsibility calculator. A great HELOC are a robust unit, however it is vital to understand the risks inside, from variable rates to foreclosure. Begin by entering your own property’s details to see your own prospective borrowing line. For each application is simply for around $dos,100,000 in the event the mortgage so you can value proportion (LVR) is over 85%. Now that the new NerdWallet “Just how much do i need to obtain calculator” gave your an idea of your to find electricity, you may also gut-look at the count with our second procedures.

If necessary, homeowners could possibly get spend LMI initial otherwise include it with the mortgage, based on how far they are obligated to pay. Equity of your home try calculated as the difference between the newest worth of your home as well as the count you have left to pay on your home loan at that time the brand new computation try did. Estimated collateral range is rates just and could not offered for everyone functions. He is centered on particular readily available guidance and you can dependent on the brand new latest amount borrowed study you type in in the ANZ Property Character Declaration consult setting, computed from the spending budget estimate. Projected guarantee range are not verification from what guarantee your may have inside property or a guarantee of your own security readily available would be to a home getting marketed. Refinancing might make feel to you personally if your state has evolved, for example, for those who have changed efforts or started a family.